Elizabeth Marshman, Associate Vice President and Director of Trusts, Estates, and Private Clients, Freeman’s | Hindman

Tangible assets are an important — and often overlooked — part of estate planning when families are considering the legacy they want to leave to heirs or charity.

Most are familiar with planning for their various types of monetary accounts from retirement to brokerage to bank accounts or a home. But families should also consider other tangible assets that are valuable after the owner passes, like jewelry, watches, coin collections, furniture, decorative art, and artwork, or even handbags, which also need to be incorporated into planning.

That’s where an expert like Elizabeth Marshman can step in to help in the estate planning or estate settlement process. She is the Associate Vice President and Director of Trusts, Estates, and Private Clients at Freeman’s | Hindman Auctions & Appraisals in West Palm Beach. She says that “while I do not give tax or legal advice, I do give advice for philanthropic planning purposes.”

Marshman also serves on the Community Foundation’s Philanthropic Advisory Council.

Tangible personal property can be used to benefit charities, such as the foundation, she said.

Having conversations ahead of time can lead to an easier transfer of tangible personal property.

“I really enjoy being brought in sooner rather than later in the process before someone passes away, whether that is creating a general inventory or an insurance appraisal,” she said. “For planning purposes, we can evaluate the tangibles in a home, and our specialists can place preliminary fair market value estimates on the items that can be sold at auction.”

It all depends on what the client or the estate planning attorney may want, she said.

The majority of the time, Marshman is brought in when someone passes away, and the heirs need an estate tax appraisal or an auction estimate.

“We have to be very clear about auction estimate values versus appraisals because those are very different valuations,” Marshman said.

Auction estimates are complimentary assessments of what an item may sell for based on comparable sales. Appraisals, however, are official evaluations that adhere to the Uniform Standards of Professional Appraisal Practice, which ensures that an appraiser is impartial, objective, and independent.

Hindman Appraisals recommends updating an appraisal every three years or whenever significant changes occur in the subject property or market conditions. Appraisal updates also depend on the category, as well as recent auction data. Once an appraisal is on file, it can be easily updated.

In a charitable area like Palm Beach and Martin counties, Marshman often counsels clients on donating proceeds from an auction to charities. An appraisal is needed for items worth more than $5,000.

Sometimes, items that are found come as a surprise to families.

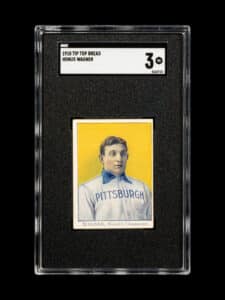

“It was the highest-graded Honus Wagner card that has ever sold on the market,” she said.

These examples demonstrate the value tangible assets can have, and without prior discussions, heirs may struggle to determine the fate of inherited possessions, especially as tastes change over generations.

“A lot of parents think, ‘My child is going to want my china, jewelry and print collection,’” Marshman said. “But sometimes they don’t want that.”

Having a plan that details what should happen to those heirlooms makes it easier for families that may be grieving after the loss of a loved one.