Simple, powerful giving. Maximum impact.

Whether your client is considering establishing a private foundation or is currently managing one, DAFs offer donors clear advantages over operating a private foundation.

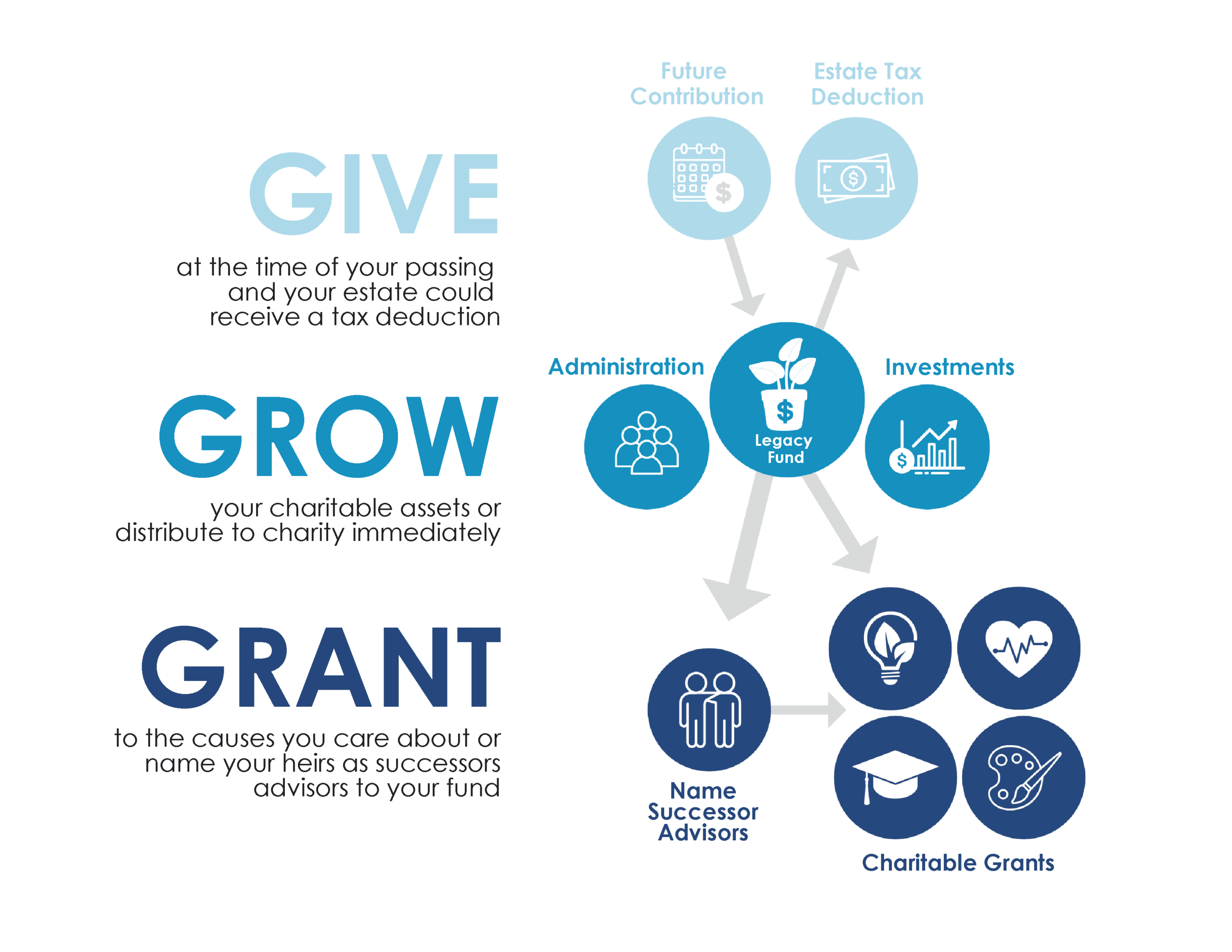

Donor-Advised Funds operate much like private foundations without the administrative burdens or paperwork. Gifts to a DAF can be made anytime or by bequest or planned gift. DAFs managed in partnership with the Community Foundation hold many advantages that make your client’s philanthropy powerful, meaningful and easy:

- Access our local experts to learn more about community needs to further your client’s charitable giving strategy and goals.

- Set-up is quick and easy with no minimums.

- Receive full back-office support. The Community Foundation manages paperwork, donor-directed grantmaking and processes payments to your client’s favorite organizations.

- Clients choose to be recognized or remain anonymous in their giving.

- Under your advisement, clients can leverage our investment expertise and select from four portfolio options, including personalized options to grow their charitable investments, resulting in more dollars to give.

- Your client can engage their children and relatives to preserve a family tradition of giving.

Transferring Private Foundations

Some of your clients with an existing private foundation may be interested in the benefits of transferring it to the Community Foundation. Through a simple transfer process, your client may avoid some of the troubles and costs of private foundation management.

There are two options to consider:

a donor-advised/other fund option or a supporting organization option.

Each approach allows your client to remain involved in grantmaking and ensure their intent, name and pattern of charitable giving are maintained in perpetuity as they wish.

Section 507 of the Internal Revenue Code permits termination of a private foundation in either trust or corporate form with distribution of its assets to a public charity.

The two primary requirements for the termination of a private foundation are:

- the private foundation must distribute all of its net assets to one or more tax-exempt organizations

- each organization must have been in existence for a continuous period of at least five years preceding the distribution.

The Community Foundation fulfills both requirements, and the private foundation’s assets are typically used to establish a permanent donor-advised fund under a similar name.

Assets of a private foundation may be used to establish a donor-advised fund, unrestricted fund, field of interest fund, scholarship fund or designated fund. Depending on the type of fund established, the private foundation's Board of Directors often stays involved in setting grantmaking priorities, advising on grant awards and assessing grant success.

It is possible for a private foundation with $2 million in assets to become a supporting organization of our Community Foundation. Besides easing the administrative and cost burdens of managing a private foundation, transferring it to a community foundation permits the private foundation to take advantage of many aspects of our public charity status.

The supporting organization option requires careful consideration by your client and our Board of Directors. We are ready to guide you and your client through the private foundation transfer process.

Your clients and community will thank you. Let our expert staff help you make the most of your client’s philanthropic potential and impact. Call Mary Katherine Morales, Vice President for Philanthropic Services, at 561-951-3450 or email her today at mkmorales@cfpbmc.org.